COVID-19 has accelerated the digitization of commerce globally. In the US, e-commerce penetration increased from 16% at the end of 2019 to 27% in April 2020. Most of the news covering the pandemic's impact on commerce has highlighted the growth in business to consumer (B2C) e-commerce. But little has been said about how business to business (B2B) commerce has changed. This focus on B2C makes sense. Over the past two decades, most major successes outside of Alibaba have been in B2C commerce (e.g., Amazon, Mercado Libre, JD, Etsy). We haven't seen large B2B-first aggregators emerge, despite the fact that the B2B commerce market is $16 trillion in the US alone.

Today, only 4% of B2B sales occur online, with Amazon Business driving at least $10 billion in sales annually. 49% of transactions are still done manually via phone, fax, or in-person meetings with sales representatives and account managers. The remaining transactions happen via electronic data exchange (EDI) and e-procurement systems, old-school technologies specifically designed for B2B transactions. The reasons for the lack of B2B aggregators are twofold: (1) brands, makers, and small manufacturers are harder to reach because they are a smaller audience that has historically been slow to adopt new technology; and (2) B2B buyer/seller transactions are complex (e.g., require payment financing, invoicing/approvals, inventory management) and requirements differ from vertical to vertical.

For better or worse, COVID-19 has accelerated e-commerce adoption among businesses in the same way it has accelerated e-commerce adoption among consumers. During the pandemic, it has become incredibly hard for businesses to manage manual transactions and procure new inventory because trade shows have been shut down and in-person interactions have been hard to facilitate. As a result, B2B buyers are looking for online platforms to help with the discovery, purchase, and financing of new products.

We believe that new and upcoming B2B players now have the tools to overcome historical constraints, and that large B2B commerce aggregators will emerge over the next decade. Further, given the complexity of B2B transactions and the different vertical requirements (think aerospace vs. chemicals vs. apparel vs. food), we think vertical marketplaces catering to wholesale needs for each specific industry are best positioned to transition B2B commerce from offline to online. At YC, we often look to Faire (YCW17) as a prime example of B2B aggregators that will emerge over the next few years.

Faire is a B2B marketplace that connects local, independent retailers with brands. In a world where you can order anything online and receive it within two days, independent retailers still travel to multiple trade shows each year, where they make procurement decisions based on gut instinct. Faire has modernized this process, enabling retailers to discover thousands of brands, purchase products online, get free returns on new orders, and finance their working capital. On the other side of the marketplace, Faire enables brands to find new customers, manage their existing customer base, and reduce their risk of non-payment.

In this post, we’ll walk through Faire’s opportunity as a B2B marketplace for independent retailers and brands. We define independent retail as independently owned retail firms with <100 employees that are either offline only or omni-channel.

First, a bit of background on why independent retail will thrive in America

Faire was founded on the insight that independent retail is not only around to stay, but in fact is positioned to thrive in the changing landscape. To do this, independent retailers will need tools to support their growth in a world that has moved online.

Public data suggest Faire’s insight is correct. US retail (which includes categories such as gifts, home goods, groceries, pharmacy goods, apparel, and cosmetics) generated $3.3 trillion of revenue in 2017. Independent retailers accounted for $752 billion (or 23%) of that. This is up from five years earlier when independent retailers generated $705 billion of revenue (adjusted for inflation). Faire’s subset of target retail verticals generated $671 billion of revenue in 2017.

These data highlight the resilience of independent retail in a world where Amazon has grown its market share over time. Among the reasons for this: Independent retailers are nimble and provide a differentiated value proposition from vertical to vertical. The retail businesses most negatively impacted by the acceleration of e-commerce are midsize and large chain stores with expansive physical footprints, which compete on price and product assortment with retailers like Amazon and Walmart.

The most common example of this phenomenon is in the books category. The growth of Amazon/e-commerce resulted in the bankruptcy of Borders in 2011 and caused Barnes & Noble to reduce its footprint from 726 stores at its peak in 2008 to 630 in 2018. In contrast, the number of independent bookstores in the US increased 49% from 1,600 stores in 2009 to 2,500 stores in 2018. Similarly, independent establishments in Faire’s core categories have grown from 1.47 million in 2012 to 1.55 million in 2017, driven by growth in health & personal care, clothing, and e-commerce.

A study conducted by Harvard Business School points to three key factors contributing to the growth in independent retail: (1) community, (2) curation, and (3) convening. COVID-19 has highlighted a fourth factor: (4) convenience.

(1) Community: Independent retailers have become staples of their communities by focusing on values that are relevant to local consumers. Successful retailers have taken community building a step further by leveraging tools like Instagram, Facebook, and Twitter. For example, Cliffs Variety, an independent home goods store in San Francisco’s Castro district, uses a Facebook page to alert neighborhood residents about store openings, pickup times, and product availability. The modern furniture store Modani has 45,000 followers on Instagram, where they share daily updates on new items. Both stores have pivoted to enable online delivery orders or in-store pickup in response to COVID-19.

(2) Curation: Rather than competing on price and inventory, successful independent retailers have focused on curating unique items to offer customers more personal experiences. For example, Claire Tibbs, who owns Humboldt House, a community shop in Chicago, sources all of her products from local brands in the Midwest region to offer her customers a SKU selection that can’t be found elsewhere.

(3) Convening: Independent stores are increasingly becoming venues for local events and community meetups. Bird & Beckett, a bookstore in San Francisco’s Glen Park neighborhood, regularly hosts poetry readings, open mic nights, and jazz performances. During the pandemic, Bird & Beckett has shifted to livestreaming events to continue serving as a meeting “place” for members of the community.

(4) Convenience: In a world where consumers expect everything instantly, local stores are able to offer same-day delivery or pickup, versus waiting 2–3 days (for most items) from Amazon and other large platforms. As consumer expectations shift toward instant shipping, independent stores are positioned to succeed. Independent retailers are further buoyed by the fact that consumers increasingly want to support their local businesses whenever possible. This was highlighted during the pandemic when shipping delays on all major platforms caused consumers to wait as long as several weeks or over a month for their purchases. During this period, consumers turned to independent retailers, who turned to new selling channels such as online orders and curbside pickup, experimented with new tactics like social selling, and introduced new merchandise categories like masks and food items. Shopify discussed this shift on their Q1 2020 earnings call: “In the six-week period since March 13, 2020, in English-speaking geographies, the percentage of customers per shop coming from within 25 kilometres of the shop’s registered address had increased, as had the number of shops with at least one local customer, while local orders in these geographies more than doubled.”

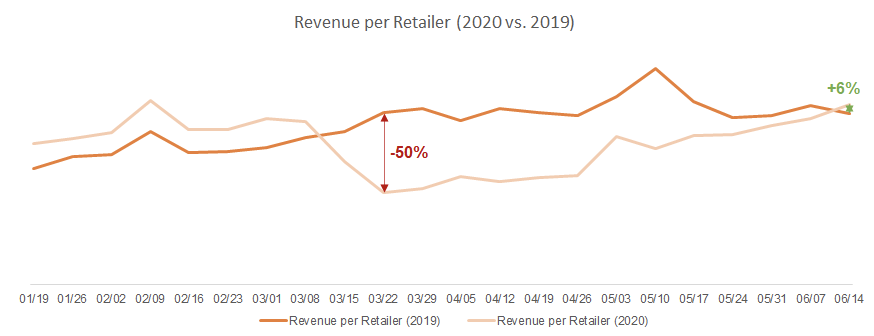

Among Faire’s retailers, 75% adapted by offering curbside pickup, local delivery, shopping appointments, or online sales. Now, about 80% of Faire’s retailers offer curbside pickup, and 50% offer personal shopping—up considerably from pre-COVID levels. Faire’s retailers also doubled down on online selling and experimented with merchandise categories in high demand during the pandemic: 40% are more heavily investing in online channels to drive demand (vs. <20% pre-COVID). Since the onset of COVID, Faire has seen categories like beauty/wellness, food/drink, and children increase from 27% to 43% of total gross merchandise value—a reflection of retailers’ ability to quickly change their category mixes. Because of these adjustments as well as the easing of lockdowns, retailers sales’ have recovered from being down 50% year/year in March to up +6% year/year in June.

Will the behavior changes from COVID-19 be permanent?

There are questions about whether the behavior changes from COVID-19 will be permanent. While it is premature to know for sure, there are three underlying trends, some of which have been accelerated by COVID-19, that point to independent retail growing over the next 5–10 years.

(1) Shift to monobrands: Monobrands—retailers that sell only one brand of products—have been growing over the past decade. Rather than walk into a department store to shop around serendipitously for multiple products, customers now prefer to go directly to products and brands on their websites and social media accounts. Independent retailers are in a position to expand monobrands’ reach by carrying their products in their stores. The advantage for monobrands is that (1) they can get their products to customers more conveniently via same-day pickup and delivery, without (2) having to invest in capital-intensive brick and mortar build outs.

(2) The desire for convenience: Independent retailers have more tools than ever to become omnichannel stores. In a matter of hours, an independent retailer can set up an online store with curbside pickup, enable delivery using last-mile logistics with DoorDash Drive (YCS13), and instantly communicate with customers using tools like Postscript (YCW19). COVID-19 has only accelerated the drive toward convenience. For example, Shopify reported in its Q1 2020 earnings call that gross merchandise value from “in-store point-of-sale declined by 71% between March 13 and April 24, but merchants managed to replace 94% of lost sales via online transactions over the same period.”

(3) De-densification: Data from the Brookings Institution suggest that migration in the US had already been shifting to the suburbs before COVID. Annual growth rates of suburban/exurban areas spiked between 2010-11 and 2016-17, while urban growth declined. As remote work becomes more widespread, we expect suburbanization to accelerate, presenting independent suburban retailers the opportunity to serve as key storefronts for brands and products with predominantly urban footprints (e.g., Everlane, Dolls Kill).

Independent retail has survived despite limited help from technology companies, but that has begun to change over the past five or so years. Companies like Faire are elevating the sophistication and speed at which independent retailers operate, enabling them to thrive in a world where commerce is increasingly shifting to large internet companies like Amazon.

The hallmark of Faire’s value proposition: Free returns and net 60-day payment terms

Before Faire, brands and retailers found one another by attending seasonal trade shows or through sales representatives selling door-to-door on behalf of brands. Both channels are inefficient and unnecessarily costly.

An average trade show has 500 exhibits and 10,000 attendees. At these events, retailers can’t efficiently browse or buy products, and a brand’s reach is limited to attendees. Independent sales representatives help brands reach new audiences, but are an expensive and hard-to-scale channel, costing between 30–40% of sales. The retailer side is similarly inefficient. Retailers across all channels often make decisions with very little data. In order to reduce inventory risk, new products make up only 20–30% of their total inventory, and retailers miss out on the opportunity to frequently add new SKUs and create a better experience for customers. On top of this, trade shows usually occur months in advance of the actual selling season, forcing retailers to commit capital and lock in inventory decisions prematurely.

Faire improves the wholesale experience for both brands and retailers. Retailers are able to discover brands more efficiently, make better decisions, and reduce their inventory risk. Faire enables discovery by aggregating supply across many categories into a single platform where retailers can manage procurement. To help retailers make better decisions, Faire predicts product sell-through based on sales at similar stores in other geographies.

But Faire’s most important product innovation has been to reduce inventory risk and increase retailers’ willingness to buy online by offering free returns, net 60-day payment terms, and bulk shipping.

(1) Free returns: Free returns are essential in wholesale because they make it possible for retailers to test sell-through rates of new SKUs without unnecessary inventory risk. Faire retailers are offered free returns on new inventory. This enables a “try before you buy” experience while retaining the “touch and feel” benefit of trade shows. Faire is able to offer this service due to their visibility into product sales data and ability to predict return rates—something that would have been nearly impossible five years ago, when most brands were offline. Their free returns policy encourages retailers to experiment with new brands and order more frequently, driving up gross merchandise volume (GMV).

(2) Net 60-day payment terms: Faire covers the upfront cost of purchases for select retailers, giving them 60 days to repay—a service traditionally available only to large retailers. This provides independent retailers with working capital to run their businesses more efficiently, leading them to place more orders through Faire. An added benefit is that brands don’t have to worry about the risk of non-payment because Faire guarantees the order.

(3) Bulk shipping: By leveraging its position as an aggregator, Faire is able to negotiate bulk shipping rates with national carriers. Faire passes on these savings to its brands, which in turn decreases shipping costs to retailers and reduces the cost of buying products online.

The combination value of improved product discovery/access and lowered costs to buy new products has leveled the playing field against big-box retailers. By aggregating demand, Faire gives independent retailers benefits that big-box retailers have enjoyed for years.

The primary reason brands are drawn to Faire is to increase their wholesale revenue. Instead of having to navigate a network of independent sales representatives or travel to trade shows, brands can sell into thousands of authenticated accounts already buying inventory on Faire. On top of that, Faire offers a suite of wholesale tools—including a CRM, chat, invoice management, automatic payments, and a mobile app—that brands can use to take orders when they do attend trade shows. Brands also get detailed sell-through analytics where they can, for the first time, understand how different SKUs are performing at retail stores. This insight is a black box for those operating in the legacy wholesale ecosystem, giving brands on Faire the competitive advantage of being able to iterate on existing product mixes, merchandising strategies, and product development in real time. Lastly, Faire gives brands a working capital advantage. Brands can choose to get paid upfront (for a fee), so they don’t have to spend their time approving credit applications and doing collections.

Faire’s platform tools also encourage brands to onboard their existing retailers so they can manage wholesale entirely within the Faire ecosystem. Combined with the demand aggregation benefits, this positions Faire as a one-stop-shop for a brand to manage their entire wholesale business. If Faire can become the single place where brands manage their business, it has the potential to be the largest wholesale aggregator in the world.

The viral loop and network effects

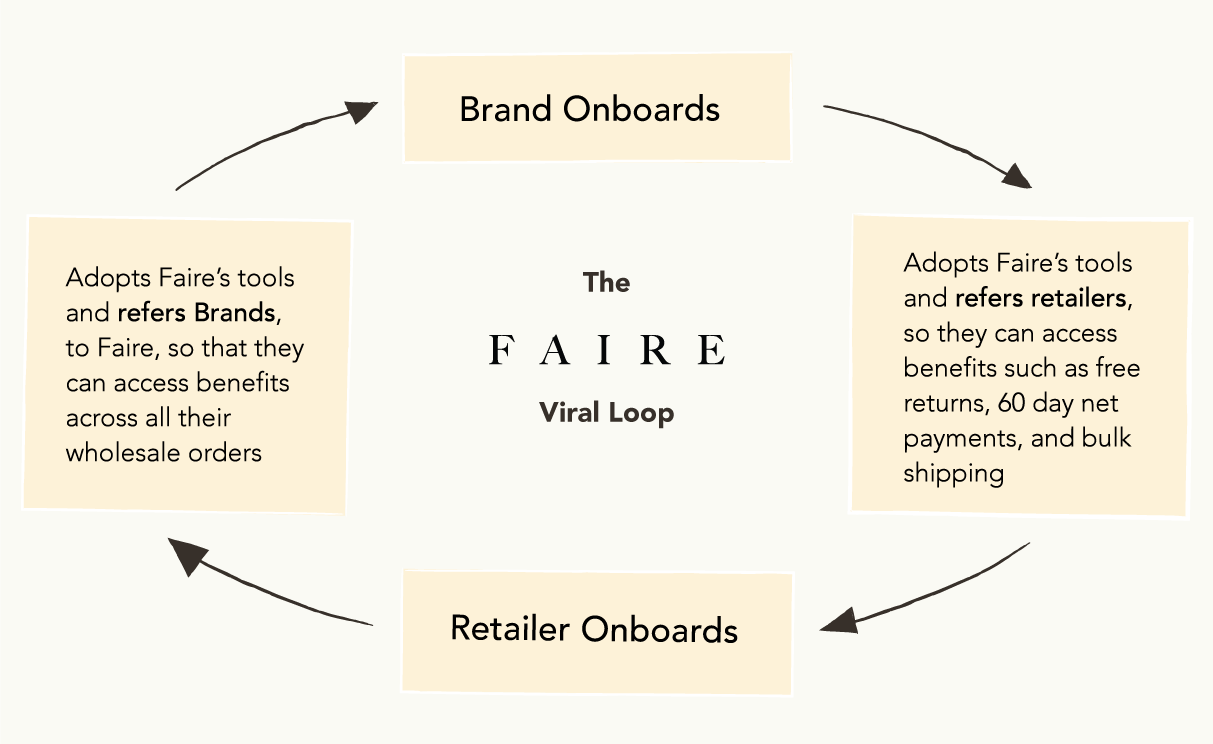

The most powerful manifestation of Faire’s model is its viral loop. Brands actively refer their retailers to Faire because they benefit from managing their wholesale business on a single platform. Retailers benefit from joining Faire because they get access to free returns, net 60-day payment terms, and more favorable shipping rates.

The viral loop enables cross-side network effects at scale: As Faire aggregates more demand (retailers) and supply (brands), the marketplace becomes more valuable to both sides. Retailers like having more brands to choose from, and brands want access to more retailers to be able to sell to. As retailers sell more, brands grow their wholesale revenue and refer more retailers. Already, Faire has 10,000 brands and 80,000 retailers on its platform. As the flywheel strengthens and Faire collects more data, retailers and brands get better recommendations and are able to sell even more.

Beyond wholesale: Neighborhood purchasing and livestreaming trade show tools

As a wholesale marketplace, Faire is uniquely positioned to offer other helpful services to retailers and brands. When lockdowns hit the US, most of Faire's retailers shut down because they were not considered essential. Meanwhile, Amazon and other e-commerce sites were experiencing surges in demand and couldn't fulfill orders in the usual two-day time frame, especially for essential items like toilet paper or masks.

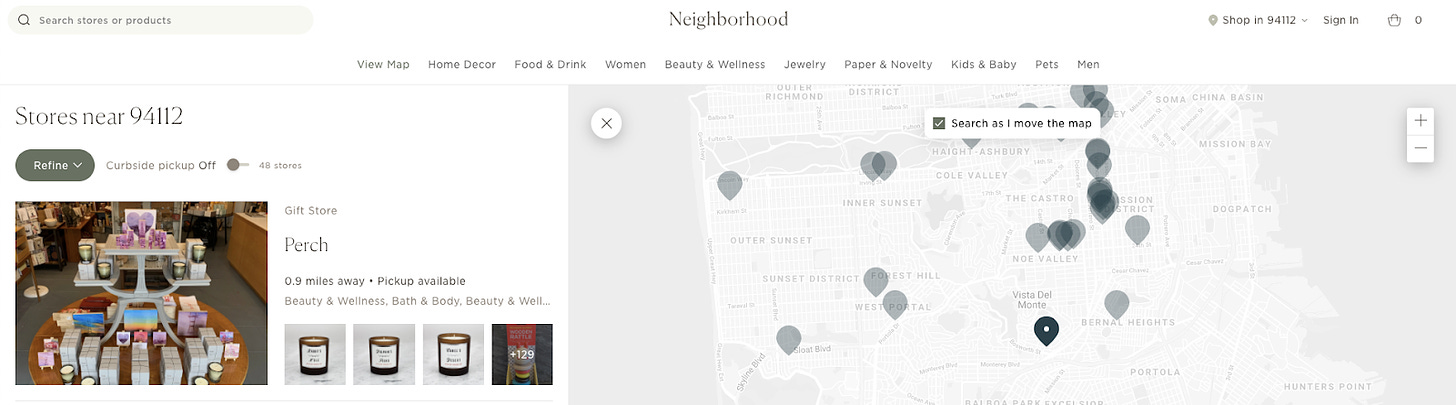

To help retailers cope with lockdowns, Faire piloted a consumer-facing marketplace, Neighborhood, giving its retailers direct exposure to consumers. Faire mobilized retailers to list essential products and built infrastructure for curbside pickup and same-day delivery. Retailers quickly sourced essential goods from Faire’s wholesale marketplace and sold these products on Neighborhood.

Though Neighborhood is still in its pilot phase, we believe the product has staying power beyond COVID-19. Now that local retailers have gone omnichannel, they have a new problem: online discovery. Neighborhood solves this by enabling retailers to list and sell products in under 15 minutes. Faire aggregates retailer data and lets consumers browse by SKU, location on a map, or retailer. Consumers then place orders for curbside pickup or same-day delivery via a logistics partner like DoorDash Drive (DoorDash's white-label logistics product). For the first time ever, local retailers can be easily discovered online and offer a similar shipping experience to larger commerce players like Amazon or Target.

Faire is also building tools to replicate the trade show experience online. Brands, particularly those that sell seasonal products, rely on trade shows. Unfortunately, due to the pandemic, most trade shows have been canceled. Faire plans to launch digital trade show tools for its retailers:

1) Live Streaming: Faire plans to offer shoppable livestream video where brands can host retailers to walk through their new collections. Building on the consumer popularity of video shopping, live streaming can mimic real-life trade show interactions. A brand can demo new products, showcase colors or textures and offer merchandising suggestions while answering live questions from buyers during the stream.

2) Brand collections: Brands will be able to present their entire catalog on Faire.com, making it easier to showcase new products and for retailers to discover them than in a traditional showroom or booth setup. On Faire, retailers can get the backstory of a product, search by values like Eco-friendly or Women-owned, and discover new best sellers for their store that will resonate with end customers.

3) Platform for digital trade show experience and year round buying opportunities: As of June 2020, 73% of B2B trade shows have been canceled presenting a significant economic challenge for brands and retailers who typically leverage trade shows and expos to kick off holiday buying season. Less than 8% of these shows offered a digital solution pre COVID-19. Faire is working with customers to build upon their existing marketplace trusted by tens of thousands of retailers and more than 10,000 brands, adding new features that will make stocking their store more efficient.

These tools won’t entirely replace trade shows. Still, we believe that trade shows (similar to sales for B2B software) will shift online and that COVID-19 has accelerated that adoption by permanently changing buying behaviors. Examples such as Pinduoduo in China show that livestream commerce can be very successful even beyond a COVID-19 world. We’re confident Faire’s virtual trade show tools will accelerate both brands’ and retailers’ willingness to transact online.

The next offline to online wave is likely to be led by B2B commerce

Over the next decade, B2B commerce companies will emerge across different verticals. Faire is not the first company to bring local wholesale online. Udaan, in India, is a wholesale platform that connects retailers to manufacturers and brands. Like Faire, Udaan offers discovery and reduces inventory risk by offering flexible returns and working capital financing. Beyond the retail vertical, companies like Meicai in China and Frubana in Colombia are bringing restaurant wholesale procurement online via first-party models.

There is no one way to build a B2B commerce company. Faire and Udaan are marketplaces and have focused on (1) discovery and (2) reducing inventory risk for retailers via innovative credit products. Meicai, on the other hand, controls the entire supply chain in order to maintain product quality for their restaurant customers. Given the nuances across verticals, founders need to adapt their offerings to solve specific issues such as product spoilage, inventory financing, and delivery times.

Lastly, it is worth noting that the B2B opportunity extends far beyond marketplaces and first-party e-commerce. For small and medium offline-first retailers, aggregators are powerful because it extends benefits otherwise not available to small businesses and drives incremental wholesale revenue for brands. For medium and large (or online-only) retailers and brands, the services needed to enable better B2B commerce are slightly different. This group needs tools and infrastructure beyond traditional systems (EDI, e-procurement systems) to simplify order creation and management and make it easier to sell on other channels. Companies like Convictional (YCW19) are building the backend tools to solve these problems.

The good news is that (1) there is now sufficient online B2B demand and (2) the core infrastructure to overcome business problems (e.g., specific payment/lending needs, logistics, online communication tools) is already available as a service or can be built with software. In the coming years, we expect the number of companies solving B2B commerce problems to only accelerate.

Thank you to the Faire team, Mia Mabanta, and Kat Mañalac for reading and editing multiple drafts of this essay.

http://dragonmartonline.ae/