Across the globe, as the novel coronavirus moves us from communal spaces into the confinement of our homes, our social experiences are forced to adapt. Beyond the social networks we already know and use, we are finding new ways to integrate social into our online lives. At Y Combinator, we are considering what this might mean for the future of E-Commerce. For several years, we have had our eye on Pinduoduo as an interesting case study. But now, as China is recovering from the impact of COVID-19, Pinduoduo and their social-shopping approach is even better poised to fully capture the offline-to-online transition in commerce. The success of Pinduoduo in China suggests there is a huge opportunity for social commerce platforms to emerge in other regions.

But first, a bit of background

When Pinduoduo launched in 2015, there was little room for a new commerce platform in China. Two major e-commerce platforms, JD and Taobao/TMall (sub brands of Alibaba), dominated online commerce in China, much like Amazon dominates in the US. During that same year, JD and Taobao generated a combined $433B of gross merchandise value. And yet, five years later, Pinduoduo is defying expectations, skyrocketing from a start-up to a 57-billion-dollar-company with an active buyer base of 585 million that generated over $144B of Gross Merchandise Value in the last twelve months. In 2020, it is China’s second largest e-commerce platform on an active user basis only lagging behind Alibaba.

Pinduoduo found room in e-commerce, not as a competitor to search-based websites like JD, but as a new e-commerce platform focused on interactive and social shopping experiences online. Social shopping may seem like a new concept, but the reality is that in the physical world, shopping is meant to be “interactive and fun” and purchases are regularly informed by friends and family. Consider how much harder it feels to purchase a new clothing item without immediate feedback from friends. e-commerce platforms like JD, Alibaba, and Amazon don’t account for this. Instead, they optimize for efficiency, funnel conversion, and purchase rates. Pinduoduo, on the other hand, has tried to mimic the offline shopping experience online by building community via their team purchase model, driving engagement via fun and interactive games and rewards, and offering personalized experiences and value via recommendations.

Consumers’ desire for social engagement while shopping is highlighted by sales within categories. Only 29% of apparel, 11% of health & personal care, and 3% of food & beverage purchases were expected to happen online in 2020 in the US (compared to 55% and 43% of books/music and computers/electronics purchases, respectively - Source: eMarketer Research Report). These numbers reveal a missing element in e-commerce. Social shopping is particularly important for categories where consumers seek feedback or recommendations from friends. Pinduoduo is one of the first companies to successfully create a social shopping experience online, and has accelerated the transition of commerce from offline to online in China.

In our view, Pinduoduo’s rapid success in social commerce will be replicated by others globally, which will continue to drive commerce in social-driven categories online. And so, to understand the success of Pinduoduo is to understand the future of global e-commerce.

Creating Community via Team Purchase

The core of the Pinduoduo experience is team purchase, where buyers form a group in order to receive discounts from suppliers. The user experience, as laid out in the graphic below, is as follows: (1) for each item, merchants decide two prices – one for individual purchase and one for team purchase. If the user opts for a team purchase, he or she may either (2.1) initiate a team purchase, or (2.2) join an existing team purchase. If the user has initiated a team purchase, he or she may use social platforms such as WeChat to proactively encourage friends to join their team (3.1) or more passively wait for other buyers to join the purchase on the Pinduoduo(PDD) platform (3.2). A team needs to be formed within 24 hours to have the order confirmed. Once a team is formed, the purchase is confirmed and the product is shipped within 48 hours.

Nearly all Pinduoduo transactions are completed using team purchase. In the early days, the size of many groups was large (e.g., 10+), but as Pinduoduo has scaled the group size requirements have declined. Team purchase is beneficial to both buyers and manufacturers; buyers benefit from better prices for goods they want and sellers benefit from increased demand and better visibility of future demand. In addition to driving down prices, team purchase helps solve the “trust deficit” of retail in China’s developing cities, where more than 80% of retail is unorganized and consumers rely heavily on social recommendations to initiate transactions.

Pinduoduo’s team purchase is often compared to Groupon in the US because they both enable a form of group buying. But the models are actually very different. First, Pinduoduo deals are designed by sellers, but initiated by consumers (i.e., users must create or join a group of a certain size to access a deal) whereas Groupon deals are designed and managed by sellers. Second, Pinduoduo’s team purchase is used for everyday goods (e.g., fruits/vegetables, apparel) that are valuable to consumers vs. one-off products/experiences that haven’t sold well elsewhere. Third, products on Pinduoduo are offered by geographically diverse merchants from across China and increasingly from all over the world. This is in contrast to the mostly local sellers that leverage Groupon to drive customers to their stores/locations. This results in a much stronger consumer value proposition as users are getting discounts on goods they might need to purchase anyway vs. letting sellers dictate discounts by aggregating demand on low-value goods or excess inventory.

To maximize this effect, Pinduoduo launched in the fruits and vegetables category. This was strategic for two reasons. 1) Incumbents were focused on non-perishable items, so competition was limited and 2) fruits and vegetables are lower order value, high frequency goods, which means users had a reason to use Pinduoduo regularly. When potential buyers saw a great deal they would forward it to their neighbors and friends via WeChat to create a team of 10+ buyers to be able to purchase the product. In return, the group initiator would get produce for free as they helped Pinduoduo acquire 10 incremental users. Because team purchase drove organic sharing of the product, Pinduoduo was able to grow its user base very quickly. Only one month after launching their first party application in January 2016 (transactions prior to this happened via WeChat), Pinduoduo already had over 10 million customers. Only four years later, Pinduoduo has grown to 585M active buyers. To compare, Alibaba crossed the 500M active buyer threshold 14-15 years after launching its consumer facing marketplace vs. just 4 years for Pinduoduo. The take away for startups is that the team purchase model is significant because it enables behaviors associated with offline commerce (e.g., sharing products or ideas with friends, browsing a shopping mall with friends) in an online setting. Team Purchase helped Pinduoduo grow quickly and create a unique recommendation engine based on users’ social interactions. While Team Purchase may be unique to China today, we expect social e-commerce to be global. New commerce platforms that can leverage social relationships will accelerate the offline to online transition and if you are able to tap into groups of social relationships vs. one-to-one relationship the faster your platforms will scale. PDD has one of the most powerful network effects in the world (Reed’s law: The value of a group-forming network is proportional to number and the ease with which groups form within it. Think Slack, WhatsApp Groups -- they all grew exponentially as they could tap into groups of social relationships)

While Team Purchase was the main reason for Pinduoduo’s rapid growth, a significant enabler of Pinduoduo’s virality was the widespread use of WeChat as a platform in China. Tencent (WeChat’s owner) is a large investor in Pinduoduo, and as a result was happy to let Pinduoduo grow on top of their ecosystem. We think it is highly unlikely that Facebook would allow a social commerce application like Pinduoduo to be built on top of Messenger or Instagram in the US. That said, messaging is fragmented in the US, so this is not an issue for US-based social e-commerce companies.

Users visit Pinduoduo without any specific intent, much like visiting a real-world shopping mall. In a shopping mall, the time that a consumer spends at the mall directly correlates with the amount he or she buys. As such, Pinduoduo has gamified the experience to maximize the amount of time a user spends on the app irrespective of whether they make a purchase or not. The primary features/experiences that have incentivized sharing and usage are Daily Check-Ins, Price Cuts, Card Programs, and Mini Games. Social commerce does not just mean connecting user accounts to Facebook. It means investing in creating physical world experiences online -- specifically bringing the fun of shopping offline to online platforms. We will walk through how Pinduoduo has implemented this below.

Daily check-ins

The daily check-in is a feature, prominently featured in the centre of the home page. It encourages daily usage by rewarding users with redeemable points each time he or she checks into Pinduoduo. The user experience is laid out in the image below. First, the user clicks the yellow icon to administer a check-in. Each time the user checks-in they are granted a small amount of money and/or credit. Over many months (and many check-ins), these rewards accumulate. In the example below, the user has accumulated 26.6 RMB of rewards. To cash out in the form of a no minimum spend voucher, the user has to reach a certain minimum value (i.e., 30 RMB).

The daily check-in is a simple yet brilliant feature that encourages users to engage with Pinduoduo on a daily basis. While each check-in does not generate revenue for Pinduoduo, the product experience eventually ties back to commerce if/when users redeem their vouchers. This theoretically should yield a higher customer lifetime value for Pinduoduo.

Price Chop

Price Chop is a feature that allows users to get products for free by sharing a custom link with their friends. The feature is outlined in detail below. Once in the Price Chop section of Pinduoduo, the user selects the goods that they want for free. Upon selection, a 24 hour timer begins. To get the item for free, the user must share their link with as many friends as possible. Every friend that clicks on the link and engages with Pinduoduo (no purchase required) drives an incremental discount for the initiator. If you don't reduce the price to 0 within 24 hours you don't get the item for free and you have to start all over again!

The product mimics the experience of “leveling” in a massive online multiplayer game like World of Warcraft whereby it becomes harder to level up as you graduate to higher levels. In the case of Pinduoduo, the difficulty is customized based on the user (i.e., easier for low-engagement users) and the item (i.e., expensive items are more difficult to chop). Additionally, similar to leveling, as you get closer to 0 (i.e., a higher level) each incremental friend that engages with your link grants smaller and smaller discounts.

Similar to Daily Check-In, Price Chop encourages users to engage with Pinduoduo, and eventually ties the engagement to an order on the commerce platform. But unlike Daily Check-In, Price Chop incentivizes users to share Pinduoduo with their social network. So in addition to increasing customer lifetime value, Price Chop also helps Pinduoduo efficiently acquire customers via user-user sharing of the product.

Card Program

Pinduoduo’s card program is designed to encourage users to share the product amongst friends and to save money via vouchers/special discounts. Pinduoduo has created several different cards that either (1) encourage certain user behaviors or (2) provide utility to a Pinduoduo user. The three most popular cards are the Free Pass Card, the Black Brand Card, and the Brand Card.

The Free Pass Card is similar to a loyalty program where users can enjoy a “team purchase discount” without having to join a team. Users usually get 1 Free Pass Card after making two purchases on Pinduoduo.

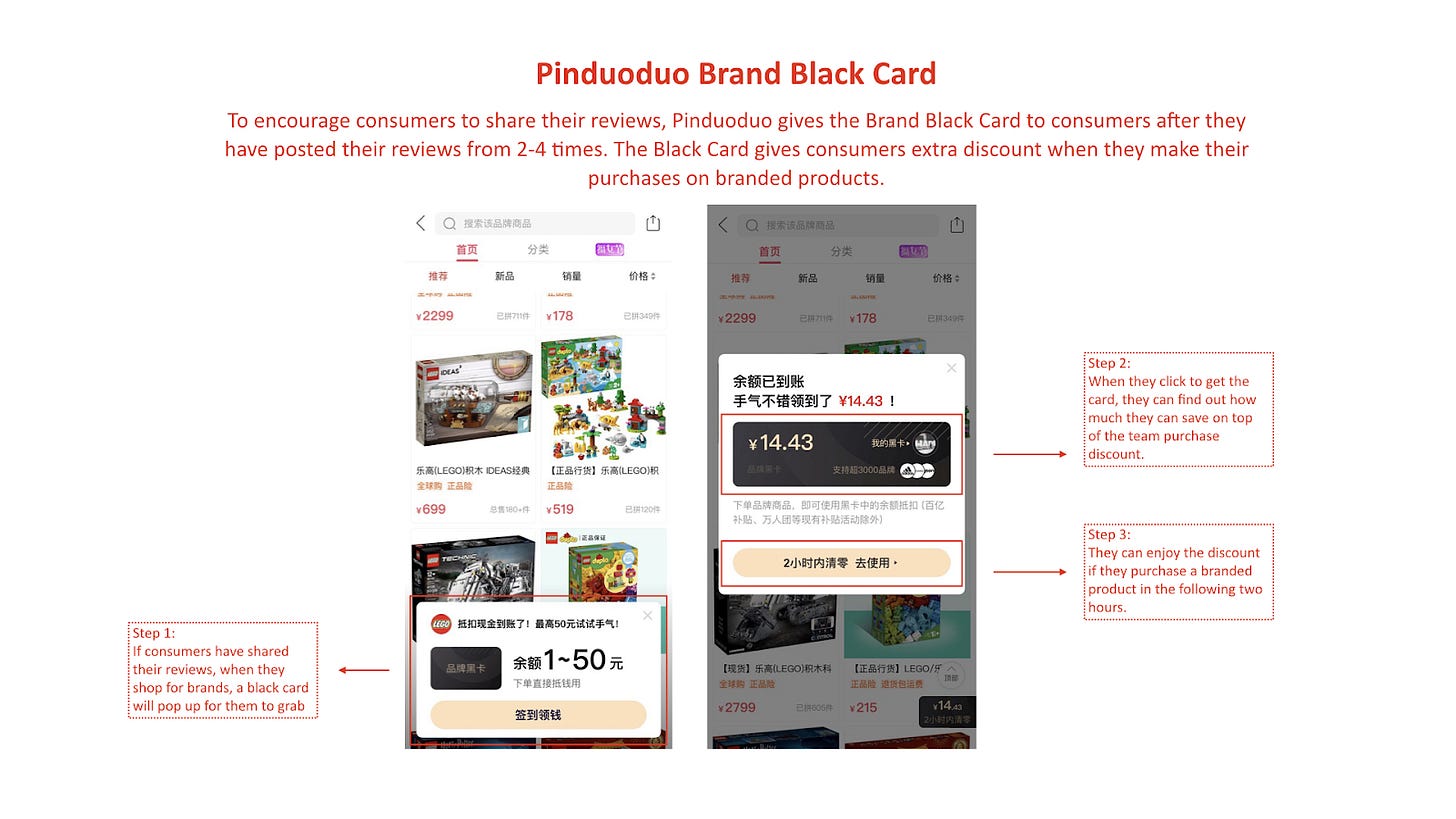

The Brand Black Card encourages users to leave reviews on the platform by offering them a discount on branded products in return. Pinduoduo gives users a Brand Black Card after they have posted 2 - 4 reviews on the website. This is important as consumers rely on reviews and recommendations from previous buyers when making purchase decisions. The Brand Black Card incentivizes a good user behavior that makes the platform better for the entire user base.

The Brand Card aims to promote Pinduoduo’s branded products. Consumers get a Brand Card after they have made a purchase on Pinduoduo. They can share their brand cards with friends via WeChat, to attract their friends to browse and buy branded products from Pinduoduo. It is an effective way to encourage users to buy branded products they would not normally buy because the recommendation/card was sent to them by a trusted friend.

This is also important because Pinduoduo has historically been used to primarily buy non-branded products. The Brand Card is an effective incentive mechanism to increase Pinduoduo’s branded product market share in China.

Mini Games

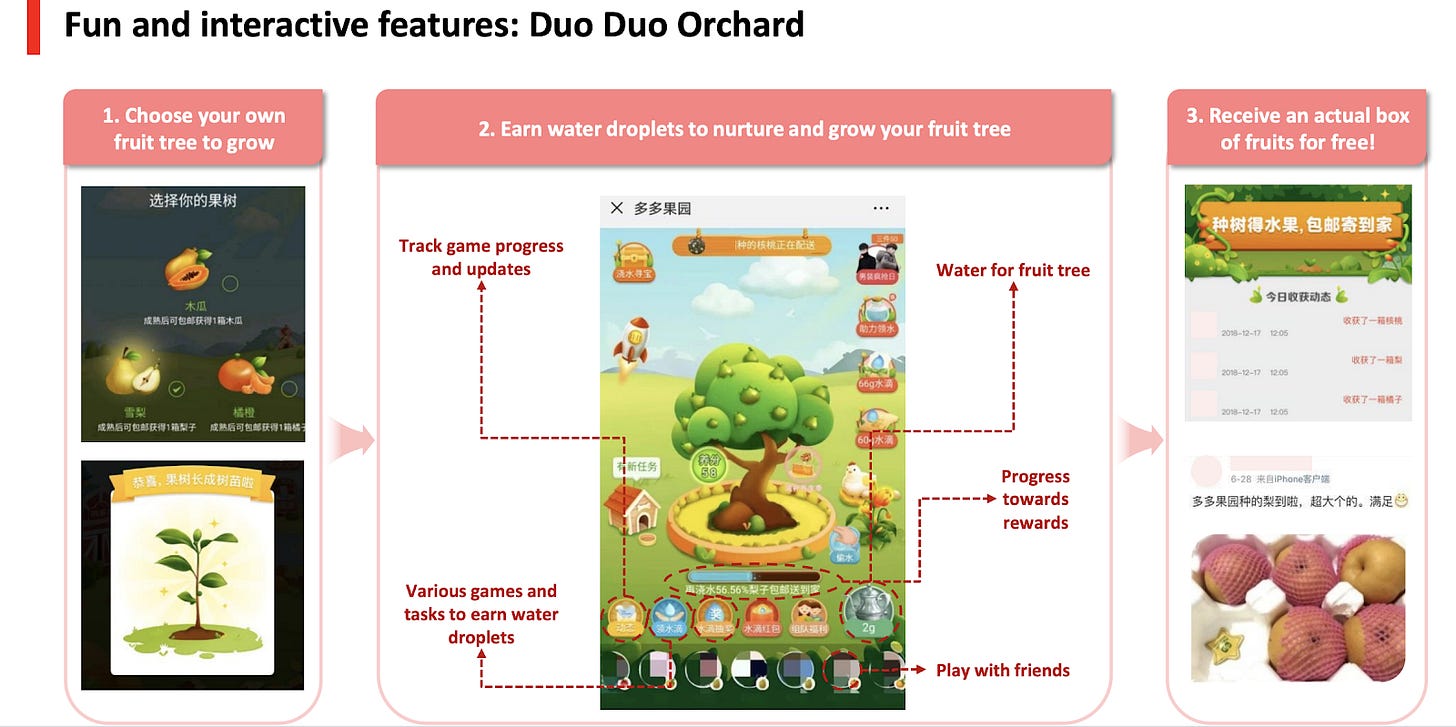

Pinduoduo wants users to engage with the platform as often as possible, and they want the experience to mimic real-world shopping. As such, they want users to engage with the app to have fun, even if it does not immediately translate into a purchase. Pinduoduo now hosts in-app games to help drive up daily time spent on the platform. The first popular game on Pinduoduo was Duo Duo Orchard. Think of Farmville except now the rewards are real physical goods. The game is simple – a user creates and nurtures a virtual fruit tree to eventually yield a real box of fruit shipped to his or her address. It already has more than 11M DAUs!

Though not multiplayer, Orchard has social cooperation aspects that drive up network engagement as well. Once users choose a tree to create (e.g., mango, lemon, macadamia nut), they need to nurture the tree with water and fertilizer. The more you shop on Pinduoduo the more water droplets you receive to nurture your tree. To encourage more interactions with friends, you can also share the water droplets. Team purchases and sharing product links enables users to obtain special tools like a water can, decorations for your orchard, or bags of fertilizer, which accelerate the growth of your tree. Pinduoduo is expanding its in app game selection. It recently launched DD Bank, a piggy bank game where users accumulate exchangeable coins over time.

Games like Duo Duo Orchard and DD Bank are ingenious because progress or “leveling” is tied to behaviors that drive financial goals for the company. By encouraging users to play games on Pinduoduo, they are able to create a win-win-win situation for merchants, consumers, and themselves. More specifically, merchants see more volume, consumers have fun and receive unique discounts, and Pinduoduo generates revenue.

Creating Value by Offering Personalized Recommendations

Lastly, unlike search-based platforms, Pinduoduo is highly personalized and recommendation based. This means that users visit Pinduoduo without any specific intent, much like visiting a shopping mall in the physical world. Based on information such as who a user’s friends are, what their favorite categories are, and which of their friend’s they trust, Pinduoduo can make recommendations that are personalized to each user. Pinduoduo is uniquely positioned to do this due to user-user sharing of the product caused by Team Purchase. The data aggregated by the platform allows the company to optimize what items a user encounters on the app by highlighting (1) products that trusted friends have already purchased or recommended and (2) products in a users’ favorite categories. For new customers, the standard practice is to show new users different categories (based on what they know about that user and their friends) and see how they interact with those categories. This is then used to create your buying persona and helps inform future product recommendations.

Beyond offering personalized product recommendations, Pinduoduo also thinks about value-for-money as a personalizable concept. Based on a user’s purchase/browsing history, Pinduoduo knows whether a user values high-cost branded clothing or low-cost non-branded clothing. Based on a user’s specific buying persona, Pinduoduo will only show you clothing items that match your willingness to pay.

The Future of Global E-Commerce

There is a huge opportunity for companies to build social into their commerce platforms to take share from transactional platforms and expand e-commerce’s overall share of spend. The success of team purchase may be specific to the commercial landscape of China, but the insights Pinduoduo has surfaced about social integration in commerce is likely entirely universal. Going forward, when building their products, founders should consider the insight that shopping is a social activity. Web 1.0 platforms - including Amazon - optimize for efficiency and don’t serve trust-based categories very well. We firmly believe that by building sharing use cases and fun experiences that mimic the fun of real-world shopping into products, commerce’s offline to online transition will accelerate.

There are large indicators that there is major demand for more sophisticated social commerce in the US marketplace already. An obvious example of this is Instagram, which has over one billion users and is now, arguably, one of the world’s largest social shopping platforms. Similarly to Pinduoduo, Instagram has fostered a browsing-based feed from friends and influencers of things that might interest consumers, often accompanied with links to purchase. The rise of the social media influencer economy alone shows that US consumers are ready to fully engage in social online shopping.

In fact, we have already seen a few companies come through Y Combinator who are trying to fill this void. Snackpass, a food app for college campuses, has built social experiences into their product. Students can send gifts to each other or hatch virtual pets together by ordering food via the app. These interactive experiences encourage increased usage of the company’s product. Meesho, a reseller marketplace in India, lets its customers create microbusinesses by selling products/goods to their friends and family via Whatsapp and other messaging channels.

Companies like Amazon will continue to grow in market share, for specific shopping needs. But it is inevitable that something will rise to fill the e-commerce-social browsing void in the US market. And the half-hearted attempts some retail platforms are making to bridge that gap are not yet cutting it. Social commerce does not just mean connecting user accounts to Facebook, it means creating new shopping experiences for buyers and sellers online.

Meanwhile Pinduoduo’s social commerce is only gaining sophistication and market influence. Pinduoduo has already aggregated enough consumer insights that they are able to collaborate with and influence manufacturers in China to cater to their user base. If there is a gap in the US e-commerce market, it is not just an opportunity to grow domestic online retail. As the pandemic drives the worlds' social lives to the Internet, there is an undeniable opportunity for companies to build social into their commerce platforms to accelerate the offline to online transition globally.

Special thanks to the Pinduoduo team and Chloe Gordon for reading and editing multiple drafts of this essay.

Really appreciate your effort to research and publish such an informative article! Many thanks!

That’s a truly inspiring article!

I’d like to suggest one more great application of social element in e-commerce.

There is a huge problem in finding your fit when shopping online for clothes and shoes.

Items from different brands or collections fit different. That’s why you have to try on before you buy.

And how you do it within ecom?

Well, what if could predict how well any item would fit before trying it on?

I believe we can because there are other people out there who already tried it on and gave their feedback.

All we have to do is to know user’s physical measurements and measurements of the others who already tried things on

Having this data we could build

ML to predict fit for anyone.